To do this, the XM Group employs the use of most favored and reputable trading platforms such as MetaTrader4 (MT4), MetaTrader5 (MT5), and WebTrader. However, the XM Group’s global trading license is acquired from the IFSC under their Belize headquarters. This is reported by some to be an offshore office, which would imply that some security in transactions and trading processes may be lacking in some unknown regions. Despite this, whether the implications are true to a certain extent or not, the XM Group is still a top-notch and trustworthy brokerage firm and an adequate choice for many other traders. Among XM’s trading conditions include charging an overnight fee when a client’s position is open for a time longer than one day.

An XM Ultra Low Account is out there with the bottom currency of USD, GBP, EUR, SGD, AUD, or ZAD. You continue to haven’t any commissions and negative balance protection. There are not any trading bonuses and no deposit bonuses, plus hedging is allowed. Anyone curious about trading with XM should even be conscious of areas where it’s not available.

Forex Advertising is available on brainyforex.com Forex ads

This development will bring numerous mutual benefits to the brokers and traders. It meant more people from the continent, which has been lagging for years, can eventually participate in the biggest market in the world. Forex brokers, on the other hand, can expand their customer base and provide competitive products.

It has regional offices in over 196 countries all over the world with noteworthy customer support readily available for communication 24/7 and in 30 different languages. The XM Group has grown indefinitely in size and popularity mainly because of the company’s sheer focus on putting the clients’ best interest above all else by providing quality services, technical support, and account bonuses. Because of these accomplishments, the XM Group has received worldwide recognition and several awards from various firms and clients for their trading services. The XM Group can be accessed through its website, XM.com as well.

XM.com User reviews

For XM Ultra Low Accounts, the leverage is identical, but spreads are often as low as 0.6 pips. There’s no leverage on Shares Accounts and therefore the spread is per the underlying exchange. As https://forex-reviews.org/xm/ previously mentioned, most of the account types available on XM are offered as Islamic accounts. Islamic or swap-free accounts don’t have any rollover or swap interest for overnight positions.

Manufacturers Query Pricing of Gas for Local Consumption in Dollars – Business Post Nigeria

Manufacturers Query Pricing of Gas for Local Consumption in Dollars.

Posted: Tue, 27 Jun 2023 03:30:09 GMT [source]

However, the market regulators should move quickly to expedite regulation governing the market to protect traders. In conclusion, the growing forex market provides an avenue for African to play a wider role in the world economy. The XM Group has a business policy always to put the client first, and that would mean creating a trading account that would fit comfortably within the clients’ needs, experience, skill, and lifestyle. On their XM.com website, you can see that they have a large selection of trading account types that could easily cater to the particular needs of its clients.

What Other Accounts Does XM Offer?

This created uncertainty in the security of income and employment even after the governments lifted the lockdowns. As a result, many people opted to look for suitable economic activity to provide an additional or alternative source of income. Now, this begs the question; what is causing the explosion of forex trading in Africa?

What might interest you most as far as XM’s loyalty program is concerned is that you have an option to redeem your accumulated points for actual cash. Compared to other forex brokers who offer Islamic accounts, XM’s offerings stand out. That’s because most brokers will give Islamic accounts higher spreads. XM, however, doesn’t apply additional charges on Islamic Accounts. As a result, the brokers are shifting to economies with less restrictive laws. The regulatory requirements are quite friendly and the market is not regulated by ESMA rules.

Consumer Products & Retail

The information provided varies by asset class and may also include min and max trade size and margin percentage. All of this information is split by account type, so you recognize where you represent each specific asset. One of the important characteristics of XM is that the company’s strive to stay human and connect with clients.

It is also a forex broker that individuals and organizations old in the trade trust with their foreign currency transactions, not just because of their experience but also owing to the many benefits they enjoy as investors. The African continent is on the verge of growth and Forex trading is one of the sectors that have experienced a massive boom. In 2020, Africa became the fastest-growing forex market in the world.

ASIC strives to promote investor certainty in the Australian market by administering the full force of the law to licensed firms. In 2009, ASIC also assumed the “Australian Stock Exchange” as part of its responsibilities. The ASIC aims to eradicate fraudulent activities relating to the financial services offered by informing the public and updating its overall supervisory framework.

- For Micro Ultra, these figures are 0.1 lots and 100 lots, respectively.

- These include forex, individual stocks, precious metals, commodities, cryptocurrencies, energies, and equity indices.

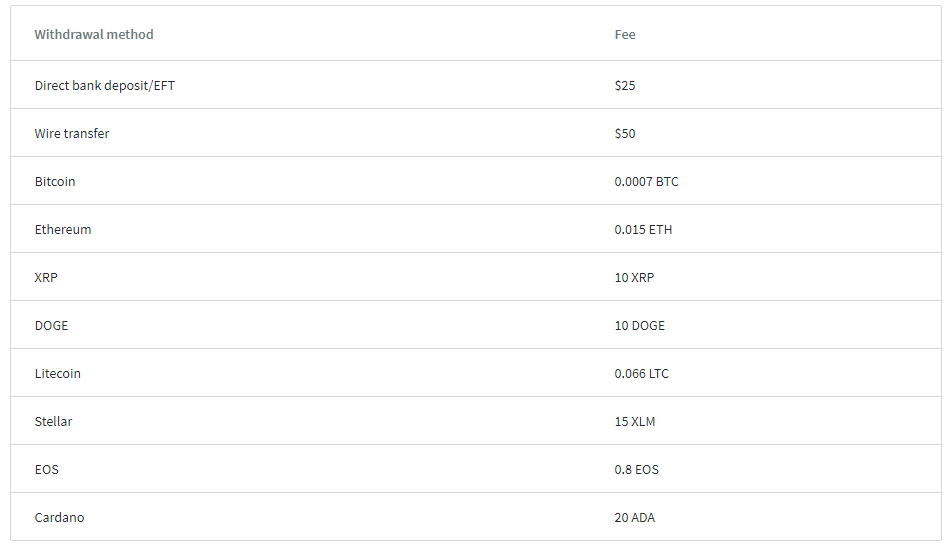

- They also permit withdrawals over $200 through wire transfer.

- XM’s efficient trading conditions contributed to its good public reputation with the rest of the market.

Australian authorities, monitoring of laws established to guarantee the morality of finances. ASIC was created for the first time as the “Australian Securities Commission” (ASC) in 1991, tasked with uniting Australian regulators. The regulatory body of ASIC is empowered to assess the efficiency of the financial markets and to revoke, suspend or grant licenses to banks, credit unions, financial companies and mortgage and financial brokers. In terms of the XM Group’s trading platforms, the broker hasn’t developed its own in attempts to make trading with them more accessible.

The XM Group is a client-oriented brokerage firm that does an excellent job of keeping their clients’ best interest at a high priority. The company is highly-respected globally for its transparency toward its client base and quality services and products that does its best to cater to clients of all backgrounds, skill, and experience in the financial market. A slight disadvantage, however, is that only newcomers to the XM Group can avail of the No-Deposit Bonus. The No-Deposit Bonus rewards the account holder with $30 that the traders can use for trading only. Only accounts that have been validated for trading are eligible for the No-Deposit Bonus.

Who won the ForexBrokers.com 2023 Annual Awards? – FinanceFeeds

Who won the ForexBrokers.com 2023 Annual Awards?.

Posted: Tue, 24 Jan 2023 08:00:00 GMT [source]

The firm can be made accountable in many EU countries such as Italy, Hungary, and France. Micro Accounts can have the bottom currency of USD, GBP, EUR, CHF, JPY, AUD, PLN, HUF, RUB, ZAR, or SGD. This sort of account has negative balance protection, trading bonuses, and no deposit bonuses. XM strives to supply a variety of learning opportunities for traders of all skill levels.